Your Financial Future: Free Budgeting Tools for Graduates 2026

Can one simple app really help you stop guessing and start growing your money after college?

You’re about to leave campus and face rent, paychecks, and loan payments. This intro shows which no-cost services let you build a clear budget fast and keep control of your finances.

We’ll preview trusted names like Goodbudget, SoFi Relay, Rocket Money, Empower, and GnuCash and what each does best. CNBC Select notes envelope-style limits, account linking, subscription tracking, goal dashboards, and desktop double-entry options; see their roundup here.

Build strong financial foundations: budgeting, saving, managing debt, credit building, and long-term money strategies.

Explore Finance Guide →- Why free budgeting tools for graduates matter in 2026

- How we selected the best free budgeting tools for graduates

- Quick comparison table: top free budgeting apps at a glance

- Goodbudget: best for beginners who want envelope-style control

- SoFi Relay: best for tracking goals across all your accounts

- Rocket Money: best for managing subscriptions and lowering bills

- Empower: best for spending and net worth tracking as you start investing

- GnuCash: best free desktop option for side hustles and microbusinesses

- Set up your first budget in under an hour

- Smart grad strategies: subscriptions, textbooks, and student fees under control

- Privacy, security, and data syncing you can trust

- Next steps to secure your financial future today

Why free budgeting tools for graduates matter in 2026

The month after graduation is the best time to turn college habits into a clear finance plan you can actually keep.

What you’ll gain: clarity, control, and confidence right after graduation

You’ll get clarity on true essentials like rent, utilities, and student loan payments versus wants. That makes it easier to match your plan to real needs.

Daily visibility into your spending helps you spot small leaks like late-night delivery before they drain your savings. Use a simple app that shows transactions each day and tracks progress toward goals.

Commercial intent decoded: how to pick tools you’ll actually use

- You’ll start a budget the month you graduate to separate essentials from wants and cover living costs.

- You’ll follow Federal Student Aid guidance here as a baseline for covering fees and textbooks.

- You’ll prioritize an emergency buffer, then assign money to moving costs or certifications with an app that tracks progress.

- You’ll decide whether you want automation, hands-on control, or subscription cuts so you pick a tool you open daily.

- You’ll use our student finance basics page to ground your plan and keep your future self organized.

Commit to a weekly check-in short reviews build habits without hours of spreadsheets and keep your money working for you.

How we selected the best free budgeting tools for graduates

To pick the best options, we measured long-term access, account safety, and features that matter as you start your career.

What counted as truly free: we included services that offer an always-available tier, not just limited trials. That means your plan won’t stop working when a promo ends. CNBC Select’s analysis guided this cutoff so our short list stays reliable over time.

Security, syncing, and real-user signals

We required bank-grade encryption (commonly 256-bit), tokenized account connections, and strong authentication. You’ll see these protections in the apps we picked: Empower, SoFi Relay, Rocket Money, Goodbudget, and GnuCash.

Practical criteria you can reuse

- Cost model: always-available access beats limited trials.

- Security: encryption, tokenization, and multi-factor login.

- Reliability: stable sync and positive user reviews matter when accounts link.

- Core features: automatic categorization, cross-account dashboards, manual control, and subscription detection.

- Data handling: clear export and reporting options so you own your information and data.

Use these steps when testing any app: check the cost terms, verify encryption on the vendor’s security page, read recent user reviews, and confirm export options. That quick checklist gives you repeatable criteria for money and finance management as you launch your first budget.

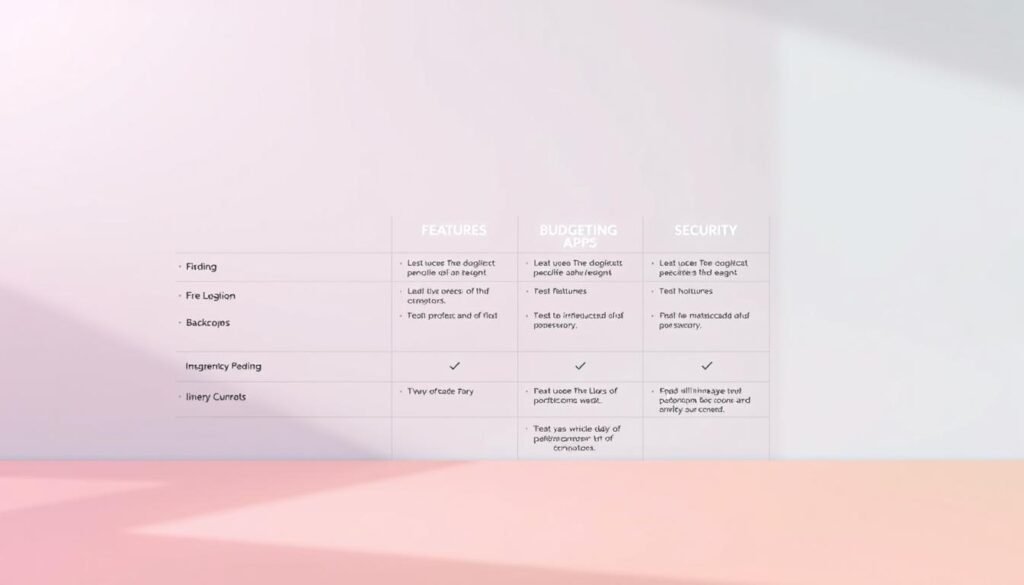

Quick comparison table: top free budgeting apps at a glance

A compact comparison makes it easy to weigh platforms by price, security, and key features.

Scan this side-by-side view to see platform support, pricing, and standout features for each option so you can decide fast.

| App | Platform & Access | Pricing | Standout features | Security / Data |

|---|---|---|---|---|

| Goodbudget | iOS, Android, Web | Free tier (20 envelopes) | Envelope-style, manual entry | 256-bit SSL |

| SoFi Relay | Web, Mobile | Free | Links external accounts, spending charts | Standard security protections |

| Rocket Money | iOS, Android, Web | Basic free; Premium $6–$12/month | Subscription detection, bill negotiation | Plaid tokenization, AWS hosting |

| Empower | Web, Mobile | Free dashboard; optional 0.89% AUM | Unified view: bank, credit, retirement, loans | Encryption, strong auth |

| GnuCash | Windows / macOS / Linux | Free desktop | Double-entry, imports bank data | Local data storage |

- You’ll see which apps link bank accounts and credit cards automatically, and which rely on manual entry.

- You’ll compare how each option helps you track spending by category and view trends by the month.

- You’ll note data and security callouts 256-bit encryption, Plaid, AWS, or local-only storage so your info is clear.

- Want more in-depth comparisons? Check curated reviews and the best app roundups at Forbes Advisor.

Goodbudget: best for beginners who want envelope-style control

Goodbudget puts envelope discipline into a simple digital system so you can tell every dollar where it goes.

Standout features and pricing

Start with the free tier that includes 20 envelopes, or upgrade to unlimited envelopes at $10/month or $80/year. The application uses manual entry, which helps you track expenses and build better money habits.

Pros and cons to weigh

Pros: shared budgets that sync across accounts, clear category limits, and helpful educational resources.

Cons: no automatic bank sync and the time needed to record each purchase.

Who it fits and why it works

Use Goodbudget if you prefer hands-on control and want a personal finance app that makes zero-based budgeting tangible. Manual entries force awareness of every transaction and reinforce budgeting habits.

Platform compatibility and data protection

Available on iOS, Android, and web. Traffic is protected with 256-bit SSL, and you can share plans with a partner. Read more about Goodbudget details here.

SoFi Relay: best for tracking goals across all your accounts

SoFi Relay brings your checking, savings, and cards into one view so you can see progress toward goals at a glance.

What it does: You’ll link bank and credit accounts to view categorized debit and credit transactions. The app shows monthly and historical trends so you can track spending and adjust savings without juggling spreadsheets.

Account linking, spending categorization, and real-time insights

Connect checking, savings, and cards to build one dashboard that reveals patterns fast. Use the trend views to set targets and monitor progress toward emergency funds or short-term goals like relocation.

Credit monitoring and expert access for extra guidance

SoFi Relay includes credit score monitoring with VantageScore 3.0 and tips to improve standing. You’ll see how new accounts or applications affect your credit as you make moves like signing a lease.

Pros, cons, and grad-ready use cases

- Pros: automated categorization, clear insights, web and mobile access, and no-cost baseline access to account views.

- Cons: uses VantageScore 3.0 instead of FICO and offers fewer advanced controls than premium platforms.

- You’ll feel secure linking accounts: user information is protected with physical and electronic safeguards so you can review money on the go.

Rocket Money: best for managing subscriptions and lowering bills

If forgotten subscriptions and surprise charges drain your balance, Rocket Money helps you find and fix them fast.

What it does: The app scans transactions to surface recurring charges, then offers a cancellation concierge so you can stop services you no longer use.

Automatic subscription detection and cancellation concierge

You’ll let Rocket Money scan your accounts to flag subscriptions that slip under the radar. Decide to cancel on your own or use the concierge to save time.

Bill negotiation, savings automation, and credit tools

Rocket Money can try to lower a bill like streaming or phone service. Negotiation is success-based and may charge a fee of roughly 35%–60% of what it saves you.

The platform includes spending alerts, category views for cards, and credit features like VantageScore 3.0 and Experian reporting. Qualifying users may see a pay advance up to $100.

The basic plan is solid. Premium runs about $6–$12 per month after a 7-day trial and adds concierge perks and advanced alerts.

- Pros: finds subscriptions, cancellation service, bill negotiation, credit checks.

- Cons: negotiation charges a success fee; premium costs add up if savings are small.

- Practical example: a forgotten streaming trial is flagged; you cancel via concierge and avoid a recurring fee.

| Feature | Access | Cost | Security |

|---|---|---|---|

| Subscription detection | iOS, Android, Web | Basic free; Premium $6–$12/mo | Plaid tokenization, 256-bit encryption, AWS |

| Bill negotiation | Web / Mobile | 35%–60% of savings | Same protections as account linking |

| Credit & advances | Mobile | Included; pay advance eligibility varies | Secure reporting partners (VantageScore, Experian) |

Try Rocket Money if you want to reclaim lost money from subscriptions and simplify monthly management. Learn more at Rocket Money.

Empower: best for spending and net worth tracking as you start investing

Track your cash flow and long-term net worth in the same dashboard to know how short-term choices affect future wealth.

Unified dashboard for bank, credit, loans, and retirement accounts

You’ll connect bank accounts, credit cards, loans, and retirement accounts to see every account in one place. Empower syncs checking, cards, IRAs, 401(k)s, mortgages, and student loans so your full picture is instant.

Budgeting vs. wealth tools: what you should prioritize first

Start with basics: set spending categories, track bill dates, and build a cash buffer before leaning on investment advice.

- Edit auto-categories so transactions reflect real life.

- Review monthly spending and savings trends to tune your plan.

- Use net worth and liabilities views to monitor student loan progress and payoff impact.

Security overview and mobile experience

Empower’s app is free; optional advisory services charge 0.89% for balances under $1M. The platform uses encryption, fraud protection, and strong authentication.

Use the mobile app for quick commute check-ins and to keep tabs on expenses and progress.

| Feature | Platform | Pricing | Security |

|---|---|---|---|

| Account sync (banks, cards, investments) | iOS, Android, Web | App free; advisory 0.89% | Encryption, fraud protection, strong auth |

| Auto-categorization & editable entries | Mobile & Web | Included | Secure data handling |

| Net worth & liabilities view | Mobile & Web | Included | Standard industry protections |

Quick steps: connect accounts, fix categories, set one savings goal, then check net worth monthly to see how small changes move the needle. Try Empower at Empower to get started.

GnuCash: best free desktop option for side hustles and microbusinesses

If you run a side gig after college, GnuCash is a desktop application that gives you double-entry control.

GnuCash tracks bank accounts, income, expense categories, and investments on your computer. The software is free and works on Windows, macOS, GNU/Linux, BSD, and Solaris, plus an Android app.

Double-entry power for invoices, payroll, and personal budgets

You’ll use double-entry accounting to separate business and personal accounts. This keeps revenue and expense lines clean and tax-ready.

You can generate invoices, log payments, and run basic payroll. Regular reconciliation with imported bank transactions makes record-keeping smooth across the year.

When a desktop-first workflow beats a mobile app

The desktop focus means your data stays local by default. That local data storage gives you control and a security edge if you prefer not to keep everything in the cloud.

The interface may feel dated, but the application’s capabilities are powerful if you plan to grow a microbusiness. Students and new grads who want firm financial management will find it reliable.

| Feature | What it does | Why it helps |

|---|---|---|

| Double-entry ledger | Tracks debits and credits | Accurate records for taxes and cash flow |

| Invoicing & payments | Create invoices and record receipts | Streamlines billing and client tracking |

| Bank imports | Import transactions from bank files | Speeds reconciliation and reduces manual entry |

| Local data storage | Files saved to your hard drive or cloud you choose | Gives control over sensitive data and backups |

Practical tip: keep separate files or accounts for each side hustle, reconcile monthly, and export reports at year end so taxes are easier. Try the official GnuCash site to download, or compare alternatives at top accounting software.

Set up your first budget in under an hour

In less than sixty minutes you’ll create a plan that maps income to real expenses. Follow these quick steps to connect accounts, assign every dollar, and automate simple saves so your money works while you focus on life after school.

Connect your accounts securely and categorize spending

Choose an app and link your bank and credit accounts. Pull in 60–90 days of history so patterns appear fast.

Review auto-categories, fix mislabels, and mark rent, utilities, transit, groceries, and student loan charges correctly.

Apply zero-based budgeting to give every dollar a job

Calculate your net income, list fixed and variable expenses, then assign every dollar so the plan ends at $0 on purpose.

Zero-based budgeting forces priorities: bills, debt, savings, and wants each get a role.

Automate savings for emergencies and student loan goals

Start with a small automation $25–$50 per paycheck to an emergency fund then add transfers for loan payments or short-term goals.

Schedule a weekly 10-minute review to adjust categories and keep spending on track.

Smart grad strategies: subscriptions, textbooks, and student fees under control

Small habits like a monthly audit and timely textbook buys let you keep essentials and cut waste. Use a few clear routines and you’ll reduce surprise charges, cover semester costs, and keep more cash for what matters.

Kill forgettable charges, keep the essentials

Run a subscription audit each month and cancel services you don’t use. Track renewal dates on your calendar so those subscriptions don’t sneak back in.

Keep only essentials and move the difference into an emergency stash or extra loan payments. Small recurring charges add up fast; trimming three unnecessary subscriptions can save money quickly.

Stretch your dollar with student discounts and buyback timing

Use your student status while it lasts to get discounts on software, streaming, and local services. Compare rentals, used copies, and e-books before you buy textbooks.

Plan resale timing: sell textbooks after finals when buyback demand is highest. Align semester cash flow with known fees and due dates by following Federal Student Aid guidance.

Want practical steps? See our guide at student finance and review card choices in this comparison card guide.

Privacy, security, and data syncing you can trust

Before you link accounts, learn how modern apps keep your bank and credit information locked down.

Bank-level encryption and strong authentication explained

Look for 256-bit encryption and tokenized connections so your bank and credit logins are never stored in plain text. That stops attackers from grabbing passwords if a vendor is breached.

Turn on multi-factor authentication and device biometrics. Also enable alerts on your cards and account activity so unusual charges or a bill spike trigger a notice immediately.

Linking to 17,000+ institutions and what that means

Wide coverage means fewer manual uploads and more accurate budgets across checking, savings, loans, and cards. Vendors often use Plaid-style APIs and host on services like AWS to sync securely.

"Many aggregators link to 17,000+ financial institutions, improving coverage and monthly insights."

- Check vendor security pages for encryption at rest and in transit, audits, and incident response.

- Verify tokenized access, review connected accounts quarterly, and remove ones you no longer use.

- Confirm whether a platform stores personal information locally or in the cloud and ask about any fee for premium sync options.

Next steps to secure your financial future today

Take three simple steps today to lock in a stronger financial routine that lasts past your first paycheck.

Pick one personal finance app, link your bank accounts and credit cards, and categorize last month’s transactions to establish a clear baseline you can track.

Write a short plan that lists income, fixed bills, and variable expense targets. Schedule a weekly 10‑minute review on the same day each month to stay consistent.

Use your chosen apps to automate transfers toward an emergency fund, near‑term goals, and student loan payments. Revisit features after a year and upgrade only if added value is clear.

Keep your finances organized with resources at. For continuing education, see Consumer Financial Protection Bureau.

Align the plan to real needs, allow one dollar of fun each week, and build momentum with small wins that compound over months and years.

Master Your Money in 2026

Learn budgeting, banking, credit building, savings, and investing with expert guides designed for students and young professionals.

Leave a Reply