Learn How to Manage Debt After Graduation Effectively

You just opened your diploma, checked your account, and felt a mix of pride and worry. One recent grad I know saw a balance near $29,000 and felt stuck. That moment sparked a clear plan and steady steps forward.

Student loan debt can feel heavy, but simple actions make it lighter. You’ll get friendly, practical guidance that maps every loan and payment, then shows repayment options based on your income and goals.

The guide includes money-saving tips, tactics for extra principal payments, and when consolidation or refinancing makes sense. Use tools like Federal Student Aid’s Loan Simulator for tailored choices, and learn about employer help and forgiveness paths.

Build strong financial foundations: budgeting, saving, managing debt, credit building, and long-term money strategies.

Explore Finance Guide →Ready for a clear plan that fits your life and time horizon? Start by checking this brief resource on federal loan options: how to manage debt after graduation.

- Start by organizing every student loan you have

- Build a realistic post‑grad budget that prioritizes loan repayment

- Choose the right repayment options for your federal loans

- how to manage debt after graduation with smart payoff strategies

- Leverage forgiveness programs and public service opportunities

- Refinance or consolidate to simplify payments and lower rates

- Your next steps to take control of student loan debt today

Start by organizing every student loan you have

Start by bringing every loan record into one clear snapshot so nothing slips through the cracks.

Create a single list that shows each balance, interest rates, minimum monthly payment, loan type, and servicer contact. That snapshot makes it easy to spot high costs and set priorities.

Create a single snapshot: balances, interest rates, loan types, servicers

Make a master record for each loan: balance, interest rates, minimum payment, type (federal or private), and the servicer’s website and phone. Keep this in a shared doc or a password manager so you can access it fast.

Federal vs. private student loans: why your options differ

Tag entries as federal loans or private. Federal student accounts often offer income-driven plans and forgiveness paths. Private loans follow lender terms and rarely give the same protections.

Set up reminders to prevent missed monthly payments

Note the exact amount due and the day of the month, then add a 5‑day early alert. Create an email folder for loan messages and save login details so service calls go smoothly.

- Pull federal student records from your servicer account and private loan details from lender portals; confirm balances and loan rates line‑by‑line.

- If cash is tight, cover minimum payments first to avoid fees and credit hits.

- Consider consolidating multiple federal loans into one payment for simpler due dates, but record how rates and terms change.

Build a realistic post‑grad budget that prioritizes loan repayment

Start by mapping every source of take‑home pay so your monthly budget matches reality.

Calculate take‑home income and separate fixed vs. variable costs

List all after‑tax income sources, including part‑time work and side gigs. That gives a clear picture of the money you have each month.

Split expenses into fixed (rent, utilities, insurance, minimum loan payment) and variable (groceries, gas, subscriptions). Track every dollar for one month to spot quick cuts.

Automate savings and payments to stay consistent over time

Automate essentials first: rent, utilities, and minimum payments. This protects your credit and avoids late fees.

Set recurring transfers to a high‑yield savings account. Even $25 per month builds an emergency cushion of $500–$1,000, then grow that to one month of expenses.

- If your employer offers a 401(k) match, grab the full match; otherwise consider small Roth IRA contributions.

- Use a simple 50/30/20 rule as a starting plan and adjust for real costs and goals.

- Try budgeting apps—start with the best budgeting apps for students for easy tracking.

| Category | Typical items | Action |

|---|---|---|

| Fixed | Rent, insurance, minimum payment | Automate payments |

| Variable | Groceries, transport, streaming | Track and trim |

| Savings | Emergency fund, retirement | Auto transfer to high‑yield |

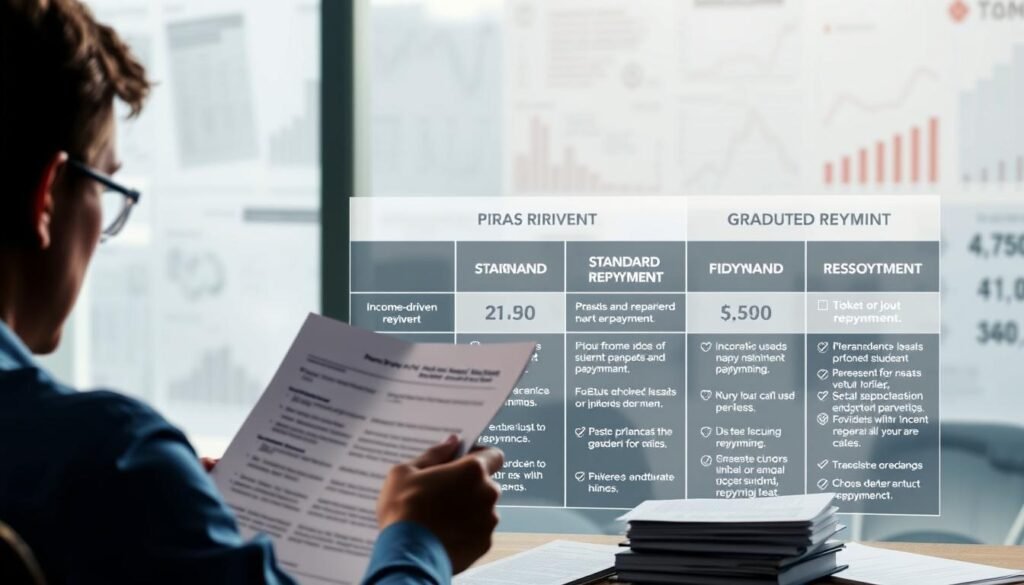

Choose the right repayment options for your federal loans

Pick a repayment path that fits your paycheck, career stage, and comfort with interest costs.

Federal student loans offer several repayment choices. Each option changes monthly payments, total interest, and payoff time. Compare the short and long terms before you commit.

Standard, graduated, and extended: quick contrasts

The Standard plan uses fixed payments over 10 years and usually yields the lowest total interest. It finishes faster if you can cover the monthly payments.

Graduated plans start lower and rise every two years. They ease early cash flow but cost more interest over the life of the loan. Extended plans stretch payments up to 25 years, cutting monthly bills but increasing total interest paid.

Income‑driven repayment (IDR)

IDR links payments to your income and family size. That can make monthly payments affordable while you build earnings. Some IDR tracks offer forgiveness after 20–25 years of qualifying payments, but paperwork and tax rules matter.

- If income is steady and you can afford it, the Standard plan often saves the most overall.

- Choose Graduated if you expect raises; pick Extended only if you need lower monthly bills now.

- IDR is best when earnings are low or uneven, and it supports Public Service Loan Forgiveness paths.

Use the Federal Student Aid Loan Simulator to compare options side‑by‑side and check projected totals. Also, save screenshots of results and confirm rates and eligibility with your servicer.

| Plan | Typical term | Monthly effect | Best if... |

|---|---|---|---|

| Standard | 10 years | Higher monthly; lower total interest | You want fastest payoff |

| Graduated | 10–12 years | Lower start, rises every 2 years | Expect steady salary growth |

| Extended | Up to 25 years | Lowest monthly; highest interest | You need low cash outflow now |

| IDR | 20–25 years | Income‑based monthly payments | Your earnings are low or variable |

Revisit your choice when income or goals change. For a quick side‑by‑side comparison, compare options with current calculators and plan details.

how to manage debt after graduation with smart payoff strategies

Pick a payoff approach that fits your personality and bank account one cuts interest fastest, the other builds momentum quickly.

Debt avalanche vs. debt snowball: which plan fits your goals

Debt avalanche targets the highest‑rate loan first. That lowers total interest and saves you the most money over time.

Debt snowball attacks the smallest balance first. Paying off a loan fast gives visible wins and keeps you motivated.

- Choose avalanche if your main goal is the lowest total interest cost; keep minimum payments on other loans.

- Choose snowball if quick wins help you stay on track; momentum matters for long campaigns.

- Automate an extra amount each month and specify that extra payment apply to principal.

- After each payoff, re‑rank targets and celebrate milestones; direct raises or refunds toward your current target.

Make extra payments to principal to reduce interest over time

Extra funds applied to principal shrink the balance and cut future interest. Focus on one target rather than splitting extra payments across many loans.

Remember: the federal student loan interest deduction can reduce your taxable income by up to $2,500 for qualified interest paid. For a practical guide on paying off balances, see this pay off debt resource.

Leverage forgiveness programs and public service opportunities

If public service appeals to you, certain options can significantly lower or eliminate federal loan balances. These paths often require years of qualifying work and careful record keeping, but the benefits can be large.

Public Service Loan Forgiveness basics

PSLF forgives remaining federal loans after 120 qualifying monthly payments while you work full‑time for eligible government or 501(c)(3) nonprofit employers. Most borrowers use an income‑driven plan so payments count.

- Confirm your plan meets PSLF rules before relying on credits.

- Submit employer certification each year and when you switch employers.

- Keep paystubs, approval letters, and payment records organized.

Teacher and state forgiveness programs

Teachers at low‑income schools may qualify for up to $17,500 after five consecutive years. Many states 45 plus D.C. run programs that help specific public service roles.

Check your state site for eligibility and limits, since benefits and rules vary widely.

Always keep a backup plan

Rules change and careers shift. Build an alternate repayment path in case timelines slip or you enter the private sector. Track projected timelines and weigh whether staying in service aligns with your income goals.

federal loan forgiveness options can offer role-specific guidance use them as part of your verification process.

Refinance or consolidate to simplify payments and lower rates

If juggling many monthly bills wears you down, consolidation or refinancing can simplify payments and might cut costs.

Federal consolidation combines multiple federal loans into one payment. The new interest rate uses a weighted average of your loan rates and is rounded up. That makes billing simpler, but it rarely lowers your current interest rates.

Federal consolidation vs. private refinancing: what changes and what you might lose

Private refinancing can lower interest rates for qualified borrowers with strong credit and steady income. Lower rates may reduce total costs and speed payoff.

Be careful: refinancing federal loans with a private lender ends access to IDR, PSLF, and other federal protections. If you plan public service work or expect forgiveness, keep federal loans intact.

When refinancing private student loans can make sense

Refinance private student loans first if you can. Compare offers from several lenders within a short window that limits credit hits. Check interest rates, repayment terms, autopay discounts, and co‑signer release options.

- Shop options narrowly and use soft‑pull prequalifiers where possible.

- Watch total costs, not just monthly payments longer terms may raise interest paid over time.

- Reassess annually as your credit and income improve for better rates and faster repayment.

| Choice | Typical effect | Best if... |

|---|---|---|

| Federal consolidation | Simplifies payments; weighted average rate | You need one bill and keep federal protections |

| Private refinancing | May lower rates and costs | You have strong credit and no forgiveness plans |

Your next steps to take control of student loan debt today

A few simple actions this month can simplify bills and protect your credit.

Start with a single checklist: gather each student loan’s balance, interest rate, minimum payment, type, and servicer contact. Run the Federal Student Aid Loan Simulator and save your preferred repayment plan and a backup.

Track one month of spending and free up $50–$100 to redirect toward payments or an emergency fund. Set autopay for monthly payments and a small automatic transfer into savings; consistency wins over big, rare efforts.

Review loan forgiveness paths such as PSLF and Teacher Loan Forgiveness and check state programs. Ask HR about employer repayment benefits many firms offer meaningful help; learn more about those options here: employer repayment benefits.

Quarterly check-in: schedule a 30‑minute review, keep records in one folder, and contact your servicer if anything changes. Small, steady steps add up make sure your plan fits your income and goals.

Master Your Money in 2026

Learn budgeting, banking, credit building, savings, and investing with expert guides designed for students and young professionals.

Leave a Reply