Best Budgeting Apps for Students USA - Manage Your Finances

You juggle textbooks, meal plans, rent, and transit on a tight income. This guide shows how to take control of your money with clear steps and realistic habits.

What you’ll get: a roadmap to identify variable income, set college goals, and pick the right tools that match your budget and lifestyle.

We’ll outline pricing, features, security notes, and step-by-step setup so you can start managing finances today. Expect quick comparisons of Goodbudget, Acorns, Digit, Rakuten, and proven standbys like Mint and YNAB.

Build strong financial foundations: budgeting, saving, managing debt, credit building, and long-term money strategies.

Explore Finance Guide →- Why budgeting apps matter for students right now

- Best budgeting apps for students USA

- Deep dive: top apps that help you save, invest, and earn cash back

- How to choose the right budgeting app for your goals

- Put your app to work: step-by-step setup and daily routines

- Smart student money moves beyond the app

- Your next steps to take control of your budget this semester

Why budgeting apps matter for students right now

College life brings unpredictable paychecks, fixed bills, and choices that strain a tight wallet.

What you’re solving: income, expenses, debt, and savings

You handle variable income while rent, tuition, and groceries stay fixed. That mismatch makes spending harder to control.

Start with a simple plan: track income, log expenses, set clear goals, and add small deposits to an emergency fund. These steps cut late fees and reduce stress.

"A spending plan and free tools can help students distinguish wants from needs and track spending."

How apps build useful habits: tracking, categories, and alerts

Apps act as practical tools that automate tracking so you see patterns without manual data entry. Use categories like textbooks, transit, groceries, and socials.

- Check your dashboard weekly to keep spending in line with goals.

- Set alerts to prevent overdraft and missed payments.

- Use in-app goals to grow a small emergency fund each month.

| Benefit | What it helps | Quick action |

|---|---|---|

| Tracking | Shows where money goes | Review weekly |

| Categories | Directs income to priorities | Set buckets for school costs |

| Alerts | Prevents missed payments | Turn on bill reminders |

Want a step‑by‑step foundation? Follow the foundational budget plan to get started today.

Best budgeting apps for students USA

College life mixes irregular paychecks with steady bills, so choices matter every week.

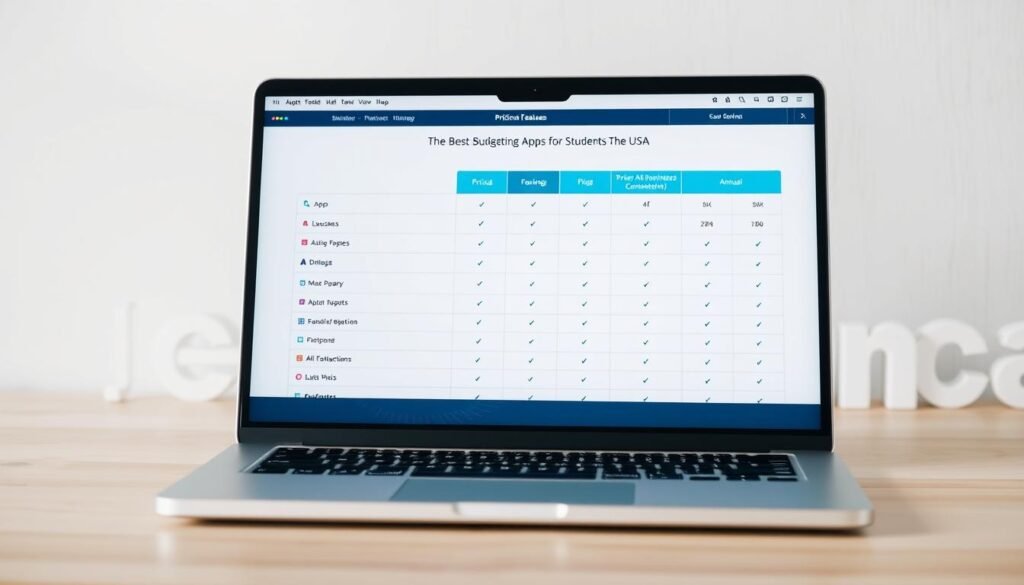

At-a-glance picks and pricing use this quick comparison to match features and fees to your goals. Below is a compact pricing and features table that highlights free tiers, monthly/year pricing, bank accounts linking, transactions automation, category rules, goals, alerts, and platforms.

Selection criteria

- Real-time tracking and transactions import

- Category flexibility and goal-setting tools

- Security: encryption and two-factor options

| Tool | Price (month/year) | Bank linking & transactions | Key student-friendly features |

|---|---|---|---|

| Goodbudget | Free (20 envelopes); $8/mo or $70/yr | Manual import | Envelope method, 256-bit encryption, iOS/Android/Web |

| Acorns | $0 to open; plans $3/$6/$12 | Auto round-ups to invest | Micro-investing, diversified ETFs, $5 min to invest |

| Digit | 30‑day trial, $5/mo | Links accounts for auto-savings | Daily savings automation, custom goals, 0.10% APY after 3 months |

| Rakuten | Free to use | Link cards for cash back | Quarterly payouts via PayPal/check, boosts savings on shopping |

Want more options? See our budgeting guide and student finance resources to tailor a plan based on your income and expenses.

Deep dive: top apps that help you save, invest, and earn cash back

Pick apps that let you track categories, automate small transfers, and earn cash back as you shop.

Goodbudget uses the envelope method to give you strict category control. Fund envelopes each month, log spending manually, and watch impulse buys drop. Quick start: create 10–20 envelopes and refill them on payday. (See security: 256-bit encryption.)

Acorns turns your spare change into diversified investments by rounding up purchases. You can add recurring transfers and unlock retirement options on higher plans. Quick start: link a card and enable round-ups.

Digit analyzes cash flow and moves small amounts daily to help you reach goals. It’s low-effort saving with a 30-day trial and a modest monthly fee. Quick start: set a goal and a max transfer cap.

Rakuten earns cash back when you shop with linked debit or credit cards. Activate offers in the app and get quarterly payouts via PayPal or check.

Proven standbys and security snapshot

- Mint for automated budgets and real-time updates.

- YNAB for zero-based discipline (student first year free).

- Splitwise for shared expenses.

| Tool | Main use | Quick start | Security note |

|---|---|---|---|

| Goodbudget | Category control | Create envelopes, log spending | 256-bit encryption |

| Acorns | Micro-investing | Link card, enable round-ups | Funds in ETFs, regulated custodians |

| Digit | Automated savings | Set goal and transfer cap | Encrypted transfers, opt-out anytime |

| Rakuten | Cash back | Link card, shop via app | Requires account consent for purchases |

Always review data sharing, transactions sync, and account permissions before connecting your bank or credit accounts.

How to choose the right budgeting app for your goals

Deciding which app fits your routine starts by listing the financial wins you want to reach.

Match features to your priorities. If you want tight control and awareness, zero-based methods like YNAB or envelope systems such as Goodbudget work well. If low-effort saving is your goal, look at automation tools like Acorns or Digit and weigh their monthly fees against the expected benefits.

Bank syncing, categories, and reminders

Decide whether automatic bank accounts syncing is essential. Auto-imports save time and show real-time balances, while manual entry can help you track spending more mindfully.

Check if the app lets you customize categories, set rules, and enable bill reminders. These features reduce late fees and protect your credit over time.

Total cost of ownership

Compare free tiers, student discounts (YNAB offers a free first year), and premium value. For Acorns and Digit, measure the fee against savings and investing automation you’ll actually use.

"Pick one main tool and a small complementary service so your plan stays simple and effective."

Use our student finance resources and the budgeting guide to test a short plan. Also visit credit resources to align app choices with debt and credit strategies before you connect accounts.

Put your app to work: step-by-step setup and daily routines

Make one clear setup session and then use short daily checks to keep it working.

Quick setup (ten minutes): install your chosen app, link the accounts you actually use, and allow recent transactions to import so tracking starts right away.

Set up categories, link accounts, and turn on custom alerts

Create categories that match real life textbooks, transit, rent, groceries, socials, and savings. Set monthly targets for each category.

Turn on alerts for low balances, overspending in a category, and upcoming bills. Schedule a five-minute daily review to check new transactions and tags.

Build your emergency fund and track debt payments inside the app

Open an emergency fund goal and automate small transfers weekly or monthly. Even $5 a week adds up and shifts your money toward safety.

Add every debt, set payment dates, and enable reminders. Track principal vs. interest so you see progress each month and keep motivation high.

- Reconcile transactions daily so categories stay accurate.

- Tag unusual expenses and adjust targets before they derail the month.

- At week’s end, scan trends, reallocate if needed, and celebrate small wins.

"A short routine beats a perfect plan you never start."

Privacy tip: use strong passwords, enable MFA, and review connected accounts. If a connection is unused, prune it. For more setup checklists and practical tips, see our budgeting guide.

Smart student money moves beyond the app

Small changes in where you buy and how you split costs can free up surprising cash each month.

Textbooks and tech: compare prices, rentals, and student discounts

Shop rentals and used copies first. Compare Chegg rentals and e-books with listings on eBay and Amazon and confirm the correct edition before you buy.

Resell books after the term to recoup costs and lower your total cost of ownership. Tap school deals and Apple Education pricing to cut device costs.

Meal plan math: dining halls, groceries, and fewer deliveries

Track your swipes for a semester, then right-size your plan to avoid unused meals. Cooking more and cutting two delivery nights a month saves money and improves your diet.

Use Splitwise to log group costs and pay balances with Cash App or Venmo so friendships stay tidy and your records stay clear. Keep your bank app open for real-time balances and alerts.

Credit done right: start small and pay on time

If you use credit cards, choose a low limit, make on-time payments, and monitor utilization to build healthy credit. For deeper help, see our student finance and credit resources.

"Stack smart shopping, clean shared-expense habits, and responsible credit use to compound savings and reduce stress."

Your next steps to take control of your budget this semester

Take one clear step today that will make your monthly cash flow calmer.

Quick action plan: pick one app Goodbudget, Acorns, or Digit and set one goal you can hit in a month. Link your main accounts, categorize last week’s transactions, and turn on two alerts so you see immediate feedback on spending and bills.

Commit to a 5-minute daily check and a 15-minute weekly reset. Start an emergency fund with a small automatic transfer and revisit the amount next month. Choose one spending habit to change this week and move those savings to debt or investments.

Use our student finance guide and budgeting resources to refine your plan. Track your data, note what works, and adjust goals as your cash flow improves.

Keep going: these small steps protect credit, reduce debt risk, and help your money support college life instead of competing with it. Try one app now and review progress in a week.

Master Your Money in 2026

Learn budgeting, banking, credit building, savings, and investing with expert guides designed for students and young professionals.

Leave a Reply